Key Takeaways

- Most contract traps are structural, not malicious - auto-renew terms and vague scopes do the damage.

- Deliverability, compliance, and POS integrations can shift mid-year while the contract does not.

- Data portability is often the hidden leverage point in marketing tech agreements.

- Month to month terms and clear exit clauses dramatically reduce downside risk.

How It Usually Starts

A dispensary is growing. Marketing feels inconsistent. A vendor offers a complete solution: texting, email, loyalty, automation - all bundled together.

The pitch sounds reasonable. The monthly price seems manageable. The agreement is presented as “standard” - 12 months, auto-renew, implementation included.

Nothing looks alarming at signing.

Where the Trap Forms

The problems rarely appear in month one. They emerge over time.

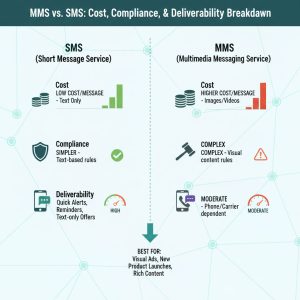

- Deliverability shifts: Carrier filtering changes. Messaging performance drops. Troubleshooting is slow or reactive.

- Compliance adjustments: New 10DLC requirements or carrier enforcement alters campaign approval patterns.

- POS changes: Integration updates introduce new fees or break automation flows.

- Staff turnover: The person who “owned” the vendor relationship leaves, and the store loses context.

The contract, however, does not adjust with these realities.

The Auto-Renew Problem

Many annual agreements contain auto-renew clauses with short cancellation windows - sometimes 30 days before term end.

If that window is missed, the contract renews automatically for another 12 months.

This is not uncommon across SaaS, but in cannabis retail, where operational conditions shift quickly, it can be especially restrictive.

The Hidden Leverage: Data Portability

The most overlooked contract detail is data export.

If customer lists, segmentation rules, consent logs, and message history are not easily exportable in a usable format, switching becomes expensive and time consuming.

Without portability, even a 30-day termination clause can feel impractical.

Why This Matters More in Cannabis

Cannabis texting operates under stricter filtering and compliance constraints than most retail industries.

If a platform is not actively managing: carrier filtering, deliverability, and compliance standards, performance can degrade while contract payments continue.

The Financial Math Most Owners Miss

A $2,000 per month contract sounds manageable.

Over 12 months, that is $24,000. Add onboarding fees, add-on modules, additional location charges, or integration costs - and the real exposure can climb significantly.

If performance drops halfway through the year, the store still absorbs the remaining term.

How to Reduce Risk Before Signing

Instead of focusing only on feature lists, operators should prioritize contract structure.

- Short initial term (60 to 90 days)

- Termination for convenience with 30 to 60 days notice

- No automatic renewal without written confirmation

- Clear data export clause

- Defined deliverables with timelines

For a detailed breakdown of these protections, read: Why Annual Contracts Hurt Dispensaries (and What to Ask for Instead).

What If You Are Already Locked In

If you have already signed an annual agreement:

- Review cancellation notice windows immediately.

- Request a current data export to evaluate portability.

- Document performance issues in writing.

- Negotiate a shorter renewal term instead of allowing auto-renew.

Final Thought

Most dispensaries do not get trapped because of bad intentions. They get trapped because contract structure does not match the speed of change in cannabis retail.

Flexibility is not about distrust. It is about operational reality.